Again, the House of Representatives has summoned the Group Managing Director of Nigerian National Petroleum Corporation (NNPC), Mr. Mele Kyari and Governor of Central Bank of Nigeria (CBN), Mr Godwin Emefiele over non-remittance of N3.235 trillion ($19.253 billion) revenue accrued from sales of domestic crude oil in 2014.

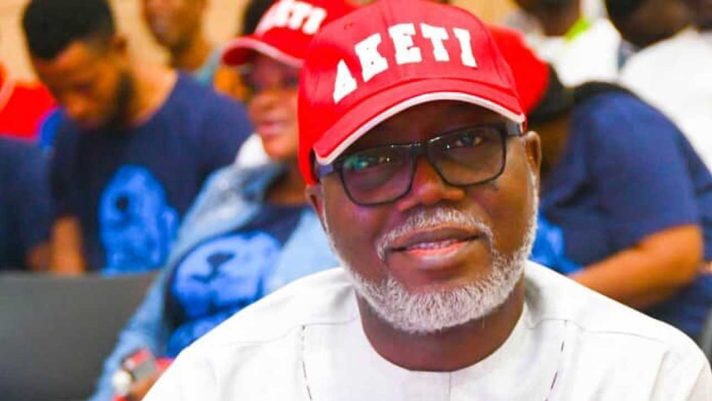

Chairman, House Committee on Public Accounts, Wole Oke issued the directive during the investigative hearing into the audit queries issued by the office of the Auditor General of the Federation (oAuGF) for the period under review.

This is coming barely 10 days after the NNPC Group Managing Director refused to honour the invitation sent to him penultimate week, on the withdrawals of $20.301 billion from the Nigerian Liquefied Natural Gas (NLNG) Dividends account.

According to the details of the query, oAuGF observed that from the “examination of NNPC mandates to CBN on Domestic Crude Oil Sales and Reconciliation Statement of Technical Committee of Federation Account Allocation Committee (FAAC) meeting held in January, 2014 that a total sum of N3,234,577,666,791.35 was not remitted to the Federation Account by NNPC within the period under review.”

The oAuGF findings further showed that, the “cost estimated for crude and product losses was N55,964,682,158.99 which is about 50 per cent of pipeline management cost of N110,402,541,010.88, names of contractors, location and amount paid to each for the pipeline maintenance were not sighted for audit verification.

“Over 31 per cent ( N826, 506, 271, 231. 26 divided by N2,636,390,514,777.18 multiplied by 100 per cent) of the realized crude sales for the year were earmarked as other expenses apart from direct cost of productions stated in NNPC reports for the year 2014. The breakdown of other expenses was not provided for audit. “From the above analysis, it means that the Federation Account is losing 31 per cent (N826,506,271,231.26) being additional estimated cost from the total amount that should have accrued to Federation Account.

From the total revenue of N3,234,577,666,791.35 as of January 14, 2015, payable to the Federation Account by NNPC during the year, the Corporation deducted the sum of N826,506,271,231.26), that is, N660,139,048,061.39, N55,964,682,158.99 and N110,402,541,010.88) for subsidy estimate, crude and product losses and pipeline management cost), respectively, at source, thereby resulting to net amount withheld figure of N2,408,041,395,560.33.

All these deductions at source by NNPC were not approved by FAAC,” the audit query read in part. While requesting the Accountant General of the Federation to inform the NNPC Group Managing Director to explain the flagrant attitude of withholding domestic crude oil sales revenue by NNPC which should be refunded immediately, the oAuGF observed that there was no positive response on a similar issue raised in 2012.

To this end, the OAuGF asked the NNPC Group Managing Director to “provide names of the contractors, location, amount paid, to each for the pipeline maintenance for verification. The process being used by PPPRA for the repayment of subsidy to the oil marketers should be used for NNPC instead of the latter deducting the subsidy at source; stop deduction at source by NNPC henceforth as this is a contravention of Section 162(1) of the 1999 Constitution which stipulates that ‘all revenue proceeds should be paid to the Federation Account’,” the report read.

While reviewing the response of the Accountant General of the Federation, Oke and members of the Public Accounts Committee argued that the NNPC and CBN should cause appearance in persons, as the Accountant General cannot provide sufficient evidence on the audit query of such magnitude.

In the same vein, the NNPC Group Managing Director is also expected to respond to other audit queries including: total sum of N248,268,291,460.87 subsidy not budgeted for in the 2014 Appropriation Act; N199,705,152,175.52 un-reconciled items in the domestic excess crude oil account since 2012 to 2014; N392,261,423,894.77 variance in the proceeds made on crude oil which was almost eroded by JVC operational cost to the extent of realizing 11.51 per cent, 20.21 per cent and 15.35 per cent in the month of January, July and September, 2014, which did not reflect prudence as a profit centre.

The Committee also invited the CBN Governor to give account on the N9,923,015,028 collected for solid minerals for the year ended December 31, 2014. The committee is also investigating the sum of $510,020,921.79 delayed payment for the crude oil lifted some days later than the due dates required for payments, by Republic of Zambia, Aridor Oil and Gas Ltd, Calson (Bermuda) Ltd, Hyde Energy Ltd, Azenith Energy Resources Ltd and Duke Oil Company.