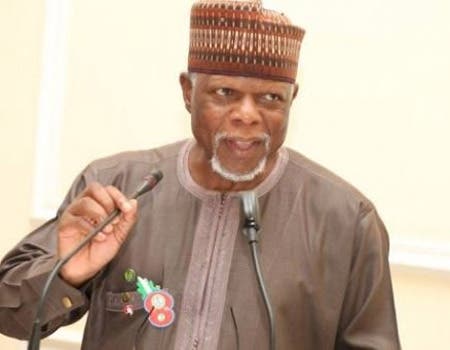

The Comptroller General of the Nigeria Customs Service (NCS), Colonel Hameed Ali (rtd), has directed the CGC Strike Force to invade warehouses and markets across the South-West for smuggled foreign rice and contrabands smuggled into the country.

Speaking, on Wednesday, against the backdrop of the seizure of 1,930 bags of 50kg smuggled rice which were evacuated from various warehouses in Lagos and Ogun State, the co-ordinator, CGC’s Strike Force, Zone A, Lagos, Deputy Compt. Ahmadu Bello Shuaibu said the directive was to boost the local production of rice in the country.

Shuaibu who lamented the high rate of cargoes that are falsely declared as machinery in other to evade Customs duty and levy said the unit generated N708millon in the last two weeks.

According to him, 1,227 rolls of chiffon textiles materials, 18 pallets of perfumes, cosmetics and bags, 2,064 cartons of electric bulbs as well as 1,810 cartons of alcoholic and non-alcoholic wines were all seized and will be forfeited to the Federal Government.

He said: “1,930 bags of 50kg of foreign parboiled rice were seized in two weeks. This is to ensure that the country is rid of smuggled foreign parboiled rice as we have instructions of the Comptroller General of Customs, Col Hameed Ali (rtd) that markets and warehouses of smugglers should be raided and smuggled rice evacuated.

“Due to the heat from the unit, smugglers have found it difficult to move smuggled foreign rice from the border in large quantity but in batches through motorcycles also known as Okada, but we have restricted them and stopped their operations.”

Speaking on the infraction, the strike force coordinator said: “We have various degree of infractions on cargoes that were seized. Cargoes such as perfumes, non-alcoholic wines, electric bulbs, footwears, bags and shoes that were falsely declared as machinery and washing machine.

“Perfumes, non-alcoholic wines, electric bulbs, textiles are dutiable but foreign footwears, bags are banned because we have factories investing heavily and employing Nigerians to produce, so we must encourage them to do more and must not discourage them through importation of those items into the country.”

Shuaibu further stated that the falsely declared cargoes have been seized outrightly and will be forfeited to the Federal Government.

“We are still appealing to our stakeholders that they should work hand in hand to ensure proper declaration and they should join hands and change their habit. Perfume is dutiable but once it is falsely declared, it is liable to seizure. Also, non-alcoholic wines are liable to seizure, we have factories that produces wines so, we should patronise them to boost the economy.”

“Chiffon materials brought in as sealing machines when we have textiles companies all around the country closing down. Though it is dutiable but because it was falsely declared, it remains seized.”

Disclosing why importers prefer false declaration to honest declaration of cargoes, Shuaibu said machinery pay five per cent customs duty and are not levied while other luxury goods like perfumes, non-alcoholic wines have high Customs duty with import levy.