The Central Bank of Nigeria has absolved itself from any liability should users of the eNaira suffer any loss or data breach on the platform.

According to the information available on the eNaira website, the CBN removed itself from being joined as a party in any future lawsuits, if users encounter losses while using the digital currency.

In the website’s ‘Terms of Service’ section, the Limitation of Liability tab states that no officer of the bank would be held responsible for losses of revenue or profit, or a malfunction of the site – even those resulting from a breach in security.

It stated, “In no event will the CBN or its directors, officers, employees, independent contractors, affiliates or agents, or any of its or their respective service providers, be liable to you or any third party for any use, interruption, delay or inability to use the eNaira website, lost revenues or profits, delays, interruption or loss of services, business or goodwill, loss or corruption of data, loss resulting from system or system service failure, malfunction or shutdown, failure to accurately transfer, read or transmit information, failure to update or provide correct information, system incompatibility or provision of incorrect compatibility information or breaches in system security, or for any consequential, incidental, indirect, exemplary, special or punitive damages, whether arising out of or in connection with the use of the eNaira website.”

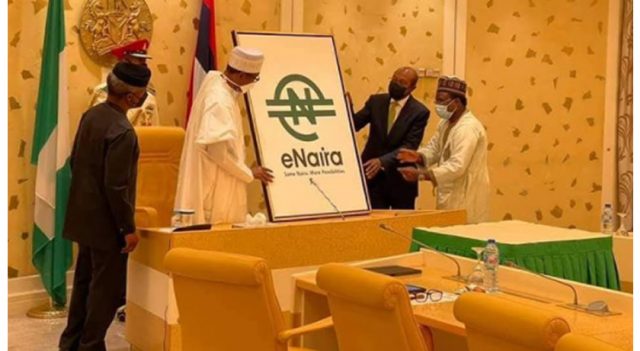

On its Privacy Policy, the apex bank stated that it would not accept any responsibility for the security of data transmitted over the eNaira website, despite the President, Major Gen. Muhammadu Buhari stating that the platform would help strengthen the country’s fiscal security.

It read, “While we use reasonable physical, electronic and procedural safeguards to protect your personal information from loss, misuse, unauthorised access or disclosure, alteration and destruction, please be advised that we do not accept responsibility for the security of any data transmitted over the eNaira website or information stored, posted or provided directly to a third party website, which is governed by that third party’s policies.”

Apart from these clauses, the CBN also stated that it “will not promise that any of the materials on this website are accurate, complete, or current.”

The bank also added that it “or its service providers will not be held accountable for any damages that arise with the use or inability to use the materials on eNaira’s website, even if CBN or its authorised representative has been notified, orally or in writing, of the possibility of such damage.”

On Monday, at the launch of the platform, the CBN Governor, Godwin Emefiele said that the bank had minted N500 million worth of DC, issuing N200 million to financial institutions in the country.

On Wednesday, the app disappeared from the Google Play Store after getting over 100,000 downloads.