Access Holdings says its subsidiary, Access Bank, has agreed to acquire a majority stake in Finance Trust Bank Limited (FTB) in Uganda.

In a statement filed on the Nigerian Exchange Limited (NGX), on Wednesday, Sunday Ekwochi, said both companies entered into a definitive agreement that involved FTB’s institutional shareholders.

The acquisition, subject to regulatory approvals of the Central Bank of Nigeria (CBN) and Bank of Uganda, will see Access Bank take up 80 percent of Finance Trust Bank.

According to the statement, the transaction, projected for completion in the first half of 2024, involves share acquisition and capital injection in FTB to increase the Ugandan bank’s capital base.

Access Holdings said FTB was founded in 1984 as Uganda Women’s Finance Trust Limited with an objective to provide financial services to low-income people in Uganda, especially women.

“The transaction involves Access Bank’s acquisition of a majority stake from existing shareholders and a capital injection by Access Bank to increase FTB’s capital base,” Access Holdings said.

“Following the conclusion of customary conditions precedent and the anticipated closing of the transaction targeted for the first half of 2024, Access Bank would own an estimated 80% shareholding in FTB.”

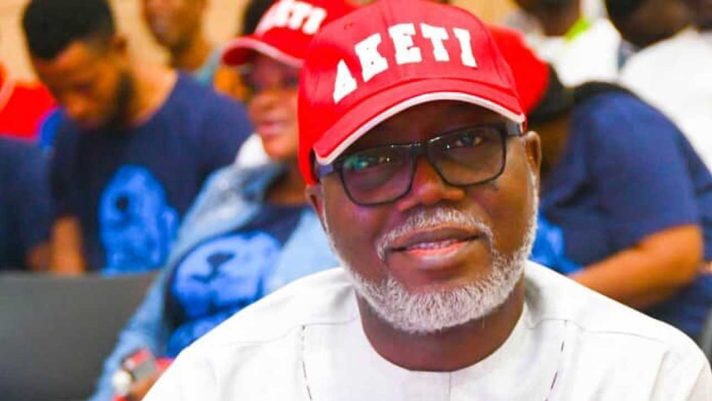

Commenting on the acquisition, Herbert Wigwe, group chief executive officer of Access Holdings, said the transaction marks an important milestone for the bank.

Wigwe said the development moves the financial institution closer to the achievement of its five-year strategic plan through continued expansion into key markets.

“We are building a strong and sustainable franchise to support economic prosperity, encourage Africa trade, advance financial inclusion thereby empowering many to achieve their financial dreams,” Wigwe said.

“The expansion to Uganda will support the realization of our aspiration to become Africa’s payment gateway to the world.”

On his part, Roosevelt Ogbonna, managing director of Access Bank, said the goal is to deliver in Ugadan, an innovative financial solution.

“Trade flows in East Africa revolve around key trade corridors, with Uganda being a key player in the region,” Ogbonna said.

“With the African Continental Free Trade Agreement, these corridors will continue to expand and by deploying our best-in-class financial solutions, we are strategically positioned to deliver value for our stakeholders.

“The transaction will enable the Bank to leverage its strong experience in the gender empowerment market to support FTB’s mission to deliver innovative financial solutions to customers especially women which currently comprises about 40% of its customers.”

Access Holdings said the bank will continue to deepen its market share to deliver sustainable profit across all countries of operations.