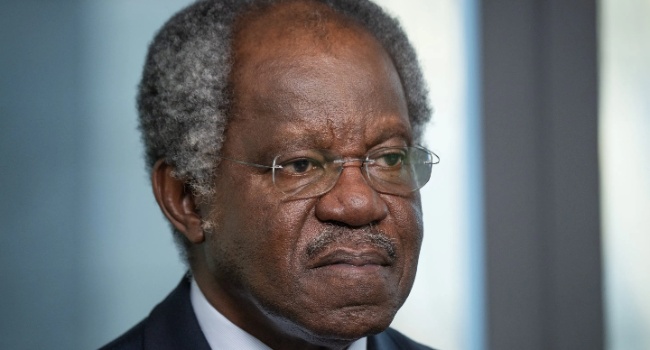

Bayo Ogunlesi, founder of the Global Infrastructure Partners, has been ranked among billionaires after BlackRock agreed to acquire his company for about $12.5 billion.

Ogunlesi’s net worth was revalued in a report by Bloomberg on Sunday, two days after BlackRock agreed to buy Ogunlesi’s GIP for billions of dollars – in cash and stock.

Described as BlackRock’s largest deal in more than 10 years, the deal entails payment of $3 billion cash and about 12 million shares, worth $9.5 billion.

Both companies are expected to close the deal in the third quarter of 2024.

Following the agreement, Ogunlesi, who is also GIP’s chief executive officer, is now worth $2.3 billion, joining the Bloomberg Billionaire Index.

Ogunlesi is a Nigerian-born lawyer, investment banker, and businessman.

He began his career as an attorney at the law firm of Cravath, Swaine & Moore in New York City before becoming an investment banker at First Boston (now Credit Suisse) and Goldman Sachs.

In 2006, he founded Global Infrastructure Partners, a private equity firm that invests in infrastructure assets, such as airports, seaports, and energy projects.

Since then, the firm has expanded to become one of the world’s leading infrastructure investment firms, with over $70 billion in assets under management.

Ogunlesi became the latest Nigerian to join the list of billionaires on Bloomberg’s index, with Aliko Dangote leading with $15.3 billion — which makes him the richest person in Africa.

Meanwhile, the number of Nigerian billionaires on the Forbes list has increased to four after the wealth tracker included Femi Otedola, the chairman of Geregu Power.

Consequently, the total wealth held by the four Nigerian billionaires stood at $29.10 billion — 28 percent of the $103.70 billion the listed 20 African billionaires are valued — as of Friday.

Forbes is yet to add Ogunlesi to its billionaire list.