Thee is growing tension between Nigerian governors and a ring of powerful presidential aides over some $418 million (about N159 billion at the current official exchange rate of $1 to N380.5) said to be owed six individuals and entities who purportedly offered services to states and their local governments on the payment of Paris Club debts.

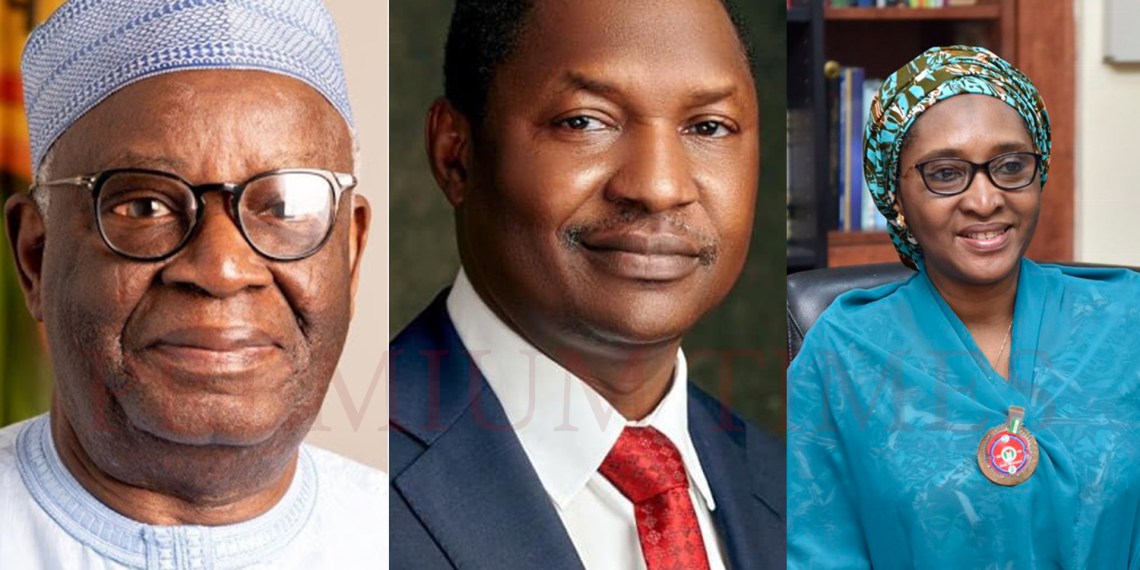

While the top presidential aides led by the Chief of Staff to President Muhammadu Buhari, Ibrahim Gambari, are scrambling to start the disbursement as quickly as possible, the governors, under the aegis of the Nigeria Governors’ Forum (NGF), led by Governor Kayode Fayemi of Ekiti State, are making a last-ditch effort to stop it.

PREMIUM TIMES is in possession of tens of sensitive correspondences exchanged by high-ranking players in the matter, highlighting desperate moves to begin the disbursements through the issuance of promissory notes that will be funded through deductions from states and local governments’ monthly allocations.

From documents seen by this newspaper, the moves to begin the payments are against Mr Buhari’s directive issued in January this year, and in disregard for the red flag raised by the governors about the legitimacy of the indebtedness.

The Fayemi-led NGF is demanding that the payment be suspended until a forensic audit of the indebtedness is carried out.

But Mr Gambari, who is spearheading the moves for the prompt payment of the money, is backed by the Attorney-General of the Federation (AGF), Abubakar Malami, and the Minister of Finance, Zainab Ahmed, both of whom argue that the court judgments which awarded the sums to the creditors must be hurriedly obeyed.

But among the three of them, Mr Malami is the only figure that has been in the picture since 2016 when the conversations among the top echelons of the Buhari administration about payment of government’s judgment debts started.

Mr Gambari only became a party to the matter following his appointment in May 2020 after the death of his predecessor, Abba Kyari, who died from COVID-19 complications in April 2020.

Mrs Ahmed also became involved following her appointment as finance minister after her predecessor, Kemi Adeosun, resigned in September 2018 in the wake of an NYSC certificate forgery scandal.

The deals that piled up judgment debts against states, LGs

Currently, the states and local governments are, by the calculations of both the Minister of Finance, Mrs Ahmed and Mr Malami, indebted to the tune of $418,953,670.59 (about N159 billion at the current official exchange rate of $1 to N380.5) to six individuals and entities.

The breakdown of the debts is contained in a series of letters sent separately by Mrs Ahmed and Mr Malami to the President and the office of Mr Buhari’s Chief of Staff. PREMIUM TIMES exclusively obtained copies of these letters.

The humongous debts arose from judgments passed in favour of the six claimants in four cases relating to the refund to the states and local governments, excess deductions made by the Federal Government between 1995 and 2002 to satisfy Paris and London clubs loans.

According to the two ministers, the claimants or judgment creditors were engaged by the states and local governments as consultants or contractors “in the recovery” of the London/Paris clubs refunds, as well as in the “utilisation” of the recovered funds.

They explained that the contracts and agreements were tied to the London/Paris clubs refunds, and the claimants had simply gone to court to claim their share of the money.

PREMIUM TIMES has found out how the suits were designed to succeed with little or no chance of failure.

Paris Club Refund Case: A Fait Accompli?

As far back as 2013, long before the Federal Government started the disbursement of the excess deductions to the states and local governments in 2016, the Association of Local Governments of Nigeria (ALGON), in concert with some of the claimants, went to court to challenge what they described as the Federal Government’s unilateral deduction of the funds from the federation account to service the foreign debts without the consent of the third tier of governments in the country.

The 776 local governments, which were the principal plaintiffs, cleverly instituted the suit along with the “consultants” and “contractors” which they claimed had provided legal and consultancy services to help them as members of ALGON to secure the refund of the deducted money.

Some other parties were also joined as co-plaintiffs in the suit for executing projects such as “security and health care delivery” for all the local governments of the federation.

With the monetary claims in the suit tied to the refund of the London/Paris Club refunds and the Federal Government agencies, which were sued as adverse parties, success was, no doubt certain.

Between 2013 and 2018, a series of similar suits relating to the Paris and London clubs money were filed in court with ALGON and past leaderships of the NGF giving tacit support to the “contractors” and “consultants”.

At the end of the day, some of the cases were feebly defended, while others were consented to by the defendants, including past NGF leaderships and ALGON.

With little or no opposition, judgments later began to fly around with huge awards in millions of dollars issued by the courts in favour of the claimants.

In his July 17, 2020 letter to the incumbent Chief of Staff, Mr Gambari, Mr Malami, who has been consistently making a case for the payment of the claimants since 2016, said the case ordinarily should not concern the Federal Government if not that the Central Bank of Nigeria (CBN) was the custodian of the funds.

He stated, “The consultants/contractors obtained the judgments for the payment of their legal/consultancy fees which judgments were further backed up with garnishee order absolute against the Central Bank of Nigeria for the attachment of these sums.”

Mr Malami explained that the Federal Government only got involved “in these claims” because “the attachment order made against the Central Bank of Nigeria and the Federal Government being the custodian and entity disbursing the funds or making the refunds.”

Beneficiaries of judgment debts

A breakdown of the beneficiaries gleaned from different letters sent to the presidency by the AGF and the Minister of Finance reveals the identities of the six persons and entities being owed a total of $418,953,670.59, about N159 billion, at the current official exchange rate of $1 to N380.5.

The beneficiaries include a former member of the House of Representatives, politician and lawyer, Ned Nwoko, who is laying claim to $142,028,941 (about N54 billion) via a consent judgment he obtained from the Federal High Court in Abuja in the suit marked FHC/ABJ/CS/148/2017.Three beneficiaries laying claim to $143,463,577.76 (about N54.6 billion) via a judgment of the Federal Capital Territory (FCT) High Court in the suit marked FCT/HC/CV/2129/2014 are: Riok Nigeria Ltd, Orji Nwafor Orizu, and Olaitan Bello.

From the total money, Riok Nigeria Limited has a share of $142,028,941.95 (about N54 billion), Mr Nwafor is entitled to $1,219,440.45 (about N464 million), and Mr Bello has a share of $215,159.36 (N81.7 million).

The claimant with the singular lion share is Ted Iseghoghi Edwards, who is laying claim to $159,000,000 (about 60.5 billion) through a judgment he obtained from the FCT High Court in suit number FCT/CV/1545/2015.

A firm, Panic Alert Security System Limited, owned by George Uboh, is also laying claim to $47,831,920 (about N18.2billion) based on another “consent judgment” it obtained in suit number FHC/ABJ/CS/123/2018, which was filed as recently as 2018.

‘Buhari approves $350million, but not enough’

PREMIUM TIMES understands from the letters exchanged over the matter that the $418,953,670.59 owed the six claimants is the agreed outstanding balance of the judgment debts followings series of negotiations with the claimants and the sharing of some $350million ordered to be released to the NGF by President Buhari in 2018.

Mr Buhari had approved the release of $350 million from the Excess Crude Account to the NGF then led by former Governor of Zamfara State, Abdulaziz Yari, as “legal and consultancy fee to defray third party claims arising from court judgments in respect of the Paris and London clubs refund”.

The presidential approval was based on the recommendation of the then Minister of Finance, Mrs Adeosun, via her letter dated July 5, 2018, and the details of the claims supplied by Mr Malami in his letter dated August 20, 2018, with reference number MJ/CIV/ABJ/104/17.

Mrs Adeosun’s successor, Mrs Ahmed, in a later letter dated December 23, 2019, with reference number FMF/PSSD/SH/01/VI/79, informed then Chief of Staff, Mr Kyari, that “the initial approval granted by Mr President in the sum of USD $350 million for settlement of outstanding legal/consultancy fees were not enough to accommodate the entire claims.”

Mr Malami also made a similar push, while explaining to the new Chief of Staff to the President, Mr Gambari, who took interest in the judgment debts matters shortly after assuming office.

The AGF in his letter in July 2020 with reference number HAGF/SH/2020/VOL.1/40, informed Mr Gambari that the claims in respect of the Paris and London Clubs refunds were “entitlements of judgment creditors who could not be paid from the initial sum of US$350million approved in August 2018 by the President.”

How beneficiaries are to be paid outstanding debts

A back-and-forth conversation between the offices of the Chief of Staff to the President, the Minister of Finance and the AGF on how the Federal Government should defray its judgment debts, arbitral awards and claims, including the Paris and London clubs-related judgment debts, started in 2016, about a year after Mr Buhari came to office.

Four alternative sources of funding were initially recommended at a meeting held between officials from the federal ministries of finance and justice, the Debt Management Office, the Budget Office and the Central Bank of Nigeria (CBN) on June 12, 2017.

There was also a later suggestion to draw the money from “recovered funds”.

In fact, the $350 million approved by Mr Buhari on August 29, 2018, was sourced from the Excess Crude Account.

Eventually, it was resolved before Mr Kyari died that all judgment debts owed by the government, including the Paris and London Clubs refund judgment debts, should be defrayed through the issuance of promissory notes.

Barely a month after assuming office as Chief of Staff, Mr Gambari, via a letter dated June 24, 2020, with reference number SH/COS/01/A/9090, requested the Federal Ministry of Justice to implement an earlier directive issued by Mr Buhari in 2017 for the “compilation, review, and analysis of pending judgment debts, arbitral awards and civil claims” which the ministry was aware of.

Mr Malami, in his reply dated July 17, 2020, to Mr Gambari, categorised the judgment debts and claims into three groups – Paris Club refunds-related debts; Top Priority Debts due to enforcement actions, and General Debts incurred by the Federal Government’s MDAs.

The schedules of various judgments and claims updating the list of 26 judgment debts and claims earlier generated by the Federal Ministry of Finance were attached as annexures to Mr Malami’s letter to Mr Gambari.

After receiving Mr Malami’s letter, Mr Gambari, via a letter dated July 24, 2020, requested the Minister of Finance to review the AGF letter and advise the presidency on the matter.

In her response, Mrs Ahmed, through her letter dated October 6, 2020, requested Mr Gambari to advise the president that for all categories of judgment creditors 100 per cent liquidation through the issuance of promissory notes is the most viable option.

She also advised that for debtors in Category A (Paris Club Refunds Related Debts), “equal monthly amount deductions from statutory allocation due to states and local councils over a period of 10 years” can be implemented.

‘Consent of FEC, governors not required – Malami, Ahmed’

After receiving Mrs Ahmed’s recommendation, Mr Gambari, in another letter dated October 23, 2020, raised other queries and sought to know if the states and local governments have formally signed off on the proposal of monthly deductions from their allocations for 10 years.

Responding to Mr Gambari, through a letter dated December 14, 2020, Mrs Ahmed said the consents of the judgment debtors – the states and the local governments – was not required.

She argued that “the consent of a judgment debtor (in this case the states/local governments) is not required before a valid judgment of a court of competent jurisdiction can be enforced.”

She however added that “both the former Chairman of Nigeria Governors’ Forum (NGF) and the Association of Local Governments of Nigeria (ALGON), had in 2019, given an Indemnity and No-Objection Letters authorising deductions from relevant statutory allocation to meet the Paris Club related claims, especially the claims by Riok Nigeria Ltd and Dr Ted Iseghohi Edwards.”

The minister explained further that the clearance of the states and local governments was equally not necessary to Mr Nwoko and Panic Alert Security System Ltd whose claims are based on “consent judgments between the judgment creditors and the Nigerian Governors’ Forum”.

On whether the resolution of the Federal Executive Council (FEC) or that of the National Assembly would be required for the issuance of promissory notes in respect of the Paris Club judgment debts, Mr Malami argued in separate letters to the then Chief of Staff, Mr Kyari, and Mrs Ahmed that it was unnecessary.

This, the AGF argued, was because “their eventual reimbursement is not tied to the Consolidated Revenue Fund of the Federation which requires National Assembly or FEC resolutions.”

He reiterated in his letters that “the initial payment of the sum of USD$350million was charged to the Excess Crude Account” with presidential approval, warning that subjecting the new payments “to these levels of approvals will certainly call the validity of the previous payment into question.”

Buhari grants new approval

Buoyed by the arguments canvassed by Mrs Ahmed and Mr Malami, the Chief of Staff, Mr Gambari, tabled the recommendations before President Buhari via a memo dated December 18, 2020, asking for approval for “the liquidation of all three categories A, B, and C by the issuance of promissory notes and not cash payments, given the current revenue challenges.”

As earlier recommended by Mrs Ahmed, Mr Gambari urged the president to approve that for the Paris Club related judgment debts, the promissory notes should be funded “by equal monthly deductions from the statutory allocations due to the affected states and LGAs over a period of 10 years.”

The president approved the proposals in his comments on Mr Gambari’s memo on December 24, 2020.

NGF protests

On May 23, 2019, few days to the end of his tenure as Zamfara State governor, Mr Yari stepped down as the Chairman of the NGF and was replaced with Mr Fayemi, governor of Ekiti State.

This change of baton came with a change in the attitude of the NGF regarding the Paris Club judgment debts.

Although, Mr Yari’s leadership had already issued an Indemnity and No-Objection Letters authorising deductions from state and local governments’ allocations, Mr Fayemi’s NGF began a series of meetings with the president, the chief of staff, the AGF, the minister of finance and other relevant stakeholders, in their bid to stop the payments.

A meeting which Mr Buhari held with Mr Fayemi on January 8, 2021, about 15 days after the president granted approval for the payments as recommended, culminated in a new presidential directive that the proposed deductions are stopped until parties agreed on the purported debts.

On February 3, Mr Fayemi also attended a meeting chaired by Mr Gambari where the issues were tabled. Others who attended the meeting were Mr Malami and the Permanent Secretary of the Federal Ministry of Finance, who represented the Minister of Finance.

Not convinced that the Mr Gambari-led camp was on the same page with him, Mr Fayemi went ahead to communicate the new presidential directive to the President’s Chief of Staff via a letter dated February 10, 2021.

The Chief of Staff, in response, wrote a letter dated February 16, 2021, with reference number SH/COS101/B/174, to the Minister of Finance asking her to review the NGF’s submissions in relation to the earlier approval granted by the president in December.

Two days later, the National Economic Council (NEC) met on February 18, 2021, where the body endorsed the resolution of the NGF and directed that an independent forensic auditor be engaged to review all related claims pertaining to the London Paris Club refunds and other debts against states for sundry services.

But despite this, the NGF believes that there are ongoing moves to go ahead with the payments especially as the forum still cannot extract the Chief of Staff’s commitment to abide by the president’s latest directive.

Mr Fayemi, therefore, wrote Mr Gambari on March 8, 2021, stating that the NGF had noticed “that there are attempts to proceed with defraying the purported debts to some consultants who claim to have executed various services to the states in respect of the London Paris Club refunds.”

“Notable among these so-called judgment creditors are Prince Ned Nwoko (Ned Nwoko Solicitors), Prince Nicholas Ukachukwu (Riok Nigeria Limited), Dr Ted Iseghohi Edwards and Dr George Uboh (Panic Alert Security Systems PASS),” the Ekiti governor added.

Mr Fayemi expressed concerns about the development, saying “it flies in the face of the meeting convened on February 3, 2021 meeting” which was chaired by Mr Gambari.

He reminded the Chief of Staff of “the resolution of the National Economic Council (NEC) authorising an independent forensic audit”.

The governor urged Mr Gambari to advise “all parties to work within the ambit of the NEC resolution in reviewing the purported judgment debts and the approvals of Mr President conveyed in your letter dated February 16, 2021, to the Honourable Minister of Finance, in order to safeguard the integrity of the Nigerian state.”

‘Ignore the governors’

Mrs Ahmed, in her recent reply dated March 10, 2021, responding to Mr Gambari’s request for her opinion on the NGF’s submissions, advised that the governors be ignored.

She anchored her opinion on, among other grounds, that the issue at stake was “not mere claims” but about implementation and enforcement of valid and subsisting judgments which she said were products of the judicial process.

She added that the judgment debts arose from the consultancy contracts and agreements tied to the London/Paris clubs refunds voluntarily entered into by the states and the local governments.

Mrs Ahmed added that the states and local governments took benefits of the services rendered by the contractors and consultants, and never denied in any of the courts that they engaged the judgment creditors or that the services were not rendered.

She said the NGF was a party “in most of the cases and had ample opportunity to ventilate its position”, but even “proceeded to enter consent judgments with the claimants in the cases of Hon. Ned Munir Nwoko and Panic Security and Consultancy Services.”

The minister said, in addition, that the Economic and Financial Crimes Commission (EFCC) and the State Security Service (SSS) have investigated most of the consultancy services, the contracts and the “judgments arising therefrom” and that in their reports submitted to Mr Malami, “they confirmed the validity and the legality of the contract and consultancy services.”

She also said the NGF had even started the implementation of the judgment debts by paying Mr Nwoko in part.

She added, “Finally, I wish to restate that the presidential approval for the liquidation of the judgment debts is in order and that the position canvassed by the chairman of the NGF and the request contained in his letters under reference is a subtle invitation to Mr President to use an administrative process to thwart or overturn judicial decisions and should be discountenanced in the interest of justice and obedience to the rule of law, as it will only further delay the liquidation of the judgment debts.

“Having taken benefits of the services rendered by the judgement creditors, it is only morally and legally right that the states and local government councils should pay for the services received in line with the judgement and orders of the courts.”

The contradiction between Mr Malami and Mrs Ahmed

But the claims by Mr Malami and Mrs Ahmed that the EFCC and the SSS had confirmed the validity and legality of the services rendered to the states and the local governments by the contractors and consultants appear contradictory.

The Minister of Finance, in her recent letter to Mr Gambari, claimed that the two law enforcement bodies investigated “most of the consultancy services, the contracts and the judgments” arising therefrom them, and in their report submitted to the AGF office “they confirmed the validity and legality of the contract and consultancy services.”

But in his letter dated July 17, 2020, which was received by Mr Gambari’s office on July 21, 2019, Mr Malami made reference to a “Recent EFCC report” which he said “was not initially served on his office but which “shows that the judgment creditor”, referring to Mr Iseghohi-Edwards, who is laying claim to $159million, “is not entitled to this sum”.

NGF’s last-ditch effort

Aside from the doubts expressed about the services said to have been rendered in the EFCC report referenced by Mr Malami, the anti-graft agency has also accused Mr Yari of mismanagement of the disbursed Paris Club funds.

Perhaps motivated by the EFCC report, the NGF has also called for a forensic audit of the whole indebtedness.

The NGF’s effort is reminiscent of the recent successful battle waged by Mr Malami and the EFCC in having the $10billion P&ID judgment suspended by a U.K. court after they were able to establish fraud in the agreement leading to the verdict.

Credit: Premium Times