A former relationship manager at First Bank of Nigeria (FBN) says loans worth billions of naira were transferred to companies related to Oba Otudeko, then chairman of the bank, even though they were granted in the name of other firms.

Adesuwa Ezenwa is currently at the National Industrial Court (NIC), Lagos, division, claiming unfair dismissal by FBN, which is listed as the sole defendant.

In her statement of facts seen by TheCable, Ezenwa (the claimant), said she was dismissed on October 5, 2016 on fraudulent loan disbursements “without any explanation” as to her culpability.

After her sack, she was invited to appear before a credit disciplinary committee reviewing facilities granted to a firm known as Supply and Services Ltd, a subsidiary of Royal Ceramics Group — a major customer of the bank.

Although the committee cleared her of having any interest in the loans disbursed, Ezenwa said she was admonished during the disciplinary proceedings for not “whistleblowing on some of the transactions approved by her group head (Mr Olatunji) and the Executive Vice President (Mrs. Cecilia Majekodunmi)”.

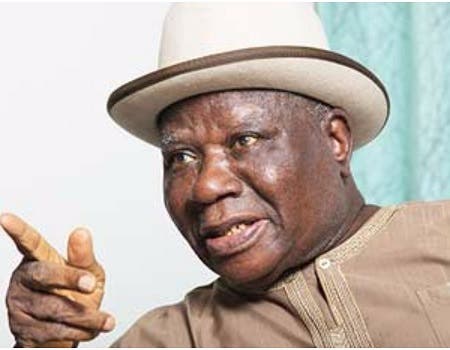

She said the admonition was most unfair and unwarranted as she was in no position to whistleblow on her superiors, “though some of the loan facilities reviewed were unsecured facilities granted to companies in which the chairman of the bank, Chief Oba Otudeko and the erstwhile Managing Director, Mr Bisi Onasanya, had substantial investments”.

“The persons to whom these reports would have been made were the very persons who were the perpetrators of the misdeeds,” her statement to the court reads.

“The impugned facilities were approved and disbursed under the direction and authority of her Group head and executive vice president and camouflaged as loans granted by some other unsuspecting customers.”

‘N12 BILLION GRANTED TO FIRM OTUDEKO HAS SUBSTANTIAL INVESTMENT IN’

In one scenario, according to her, “unsecured facilities” worth about N12 billion were “granted to a company in which Oba Otudeko has substantial investment”.

However, the “loan was camouflaged as loans granted to the Stallion Group of Companies, which at a point in time discovered this false entry in its statement of account and protested same”.

An unsecured credit facility is a loan granted to businesses without the requirement of collateral.

In another instance, she said, an “unsecured facility” of N2 billion was granted in 2012 to Broadwaters Resources Company Nigeria Ltd, which she said turned out to be a mere conduit pipe employed by Majekodunmi and Onasanya “for siphoning monies from the bank”.

The loan, according to the court filing, was never repaid.

“Out of the N12 billion camouflaged as lending to the Stallion Group, N8.21 Billion was transferred through various accounts to a final destination account belonging to a company known as V TECH LTD which belongs to the Chairman of FBN Holdings, Oba Otudeko while the sum of N4.45 Billion out of the same fictitious facility was transferred to Ontario Oil and Gas. The facility remains unpaid to date,” the document reads.

“These were not the only acts of malfeasance by the top management of the Bank but several other transactions were undertaken by other top management staff for which the Plaintiff is being punished.

“Apart from funds camouflaged as loans granted to the Stallion Groups, similar loans were granted over the years by Mr. Olatunji (the Branch Manager) and Mrs. Cecilia Majekodumi to other customers of the Bank amongst which are SUPPLIES AND SERVICES LTD. Supplies and Services Ltd is a subsidiary of ROYAL CERAMICS GROUP OF COMPANIES and several loan approvals were initiated and authored by Mr. Olatunji and Mrs. Majekodunmi.

“The facilities granted to Supplies and Services Ltd was subsequently sublent and disbursed in smaller bits to several customers on more profitable terms to both officers and these customers include Swap Technologies and Telecomms Plc, Netconstruct Nigeria Ltd, Orbit Cargo, High Performance Distributions Ltd etc.

“Some of the transactions undertaken by the Bank are already being investigated by the Economic and Financial Crimes Commission (EFCC). Their investigations/Report will be relied on at the trial.”

Ezenwa said given the size of the loans, the board of the bank “cannot but be complicit in the lendings, which were above the limits of the executive directors, vice-president and managing director of the bank”.

TheCable has contacted Otudeko on these allegations but he is yet to response.

OTUDEKO AND HIS CONTROVERSIAL BANK DEALS

The businessman is no stranger to bank deals that end up becoming controversial.

Some FBN Holdings shareholders protested after Otudeko purchased 4,770,269,843 units of FBN Holdings’ shares through his Honeywell Group.

The purchase brought the stake held by the company in the premier bank to 13.3 percent.

However, a few days after the purchase, Ecobank wrote a letter to FBN Holdings, asking the bank to reject Otudeko’s bid to become its largest shareholder.

In July, the Securities and Exchange Commission (SEC) said it was investigating the acquisition of 4.77 billion shares of FBN Holdings by Otudeko.

The outcome has not been made public.

Credit: TheCable