The Asset Management Corporation of Nigeria (AMCON) has called on all agencies of the Federal Government and all stakeholders to join its debt recovery drive as the company hopes to secure an outstanding N4.4trillion.

AMCON in a statement issued on Sunday noted that a failure to recover the debt would further worsen the nation’s economy.

According to the agency, the N4.4trillion is bigger than the entire 2021 capital expenditure budget of the Federal Government, which stands at N3.85trillion.

If recovered, the agency believes that the money can go a long way in reviving the iron and steel sectors, as well as improving electricity in the country.

It also believes that this would involve the employment of more manpower which in turn would reduce the crime rate in the country.

“AMCON assured that it is determined to recover these debts because the money belongs to Nigerian taxpayers,” the statement read in part.

Read the full statement below.

The Asset Management Corporation of Nigeria (AMCON) has raised a New Year alarm, calling on all agencies of the Federal Government and all stakeholders to join its debt recovery drive to guide against the huge opportunity cost of not recovering its huge total current exposure.

The Corporation disclosed that its current exposure stands at N4.4trillion.

This colossal outstanding going by the 2021 budget estimate rivals the entire budget of the 36 states of the Federal Republic of Nigeria.

N4.4trillion, which is owed AMCON is bigger than the entire 2021 capital expenditure budget of the federal government of Nigeria, which stands at N3.85trillion. It is also bigger than the N3.12trillion for total foreign debt service for 2021 and personnel cost of N3.7trillion.

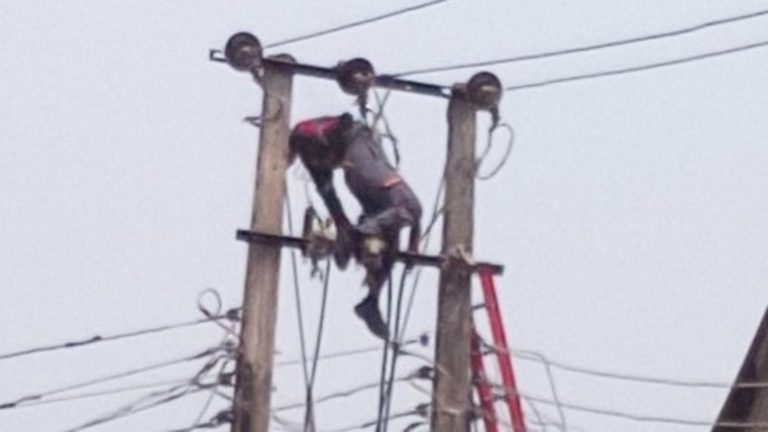

The development of the iron and steel sector as well as the electricity sector are essential ingredients to industrialisation in any country and the debt owed AMCON can do a lot in improving electricity generation and distribution as well as revival of the challenged iron and steel sector.

Similarly, AMCON added that the huge debt if recovered would be enough to capitalize over 2million Micro Businesses with N2million cash injection each or 200,000 Small and Medium Enterprises (SMEs) with N20million per SME, which would create over 10million jobs in the country.

By so doing, the agency said thousands of unemployed youths who are involved with all sorts of violent crimes would be engaged positively.

With all these facts and its negative effect to the economy, the Corporation explained that it would not be fair to allow this crop of obligors that have collectively destroyed the commonwealth of Nigerians escape justice, which is why it is calling on all sister agencies to support the recovery drive.

AMCON assured that it is determined to recover these debts because the money belongs to Nigerian taxpayers.

These startling revelations were contained in a paper Mr Joshua Ikioda, the Group Head of AMCON Enforcement presented in Abuja, which was titled “Overview of AMCON from Cradle to Date and the Implication of the Bad Debt to the Nigerian Economy.”

He made the presentation at the just concluded 2-day training for Federal High Court Legal Assistants and Court Registrars in Abuja.

The event was declared open by Hon. Justice Inyang Ekwo of the Federal High Court, Abuja, and attended by Dr Eberechukwu Uneze and Mr Aminu Ismail both Executive Directors of AMCON as well as Hon. Justice Nkeonye Evelyn Maha also of the Federal High Court.

AMCON MD/CEO Mr Ahmed Kuru in his keynote address at the beginning of the training, which ended at the weekend said AMCON cannot over flog the important role of the Judiciary in national development and as such remains vital to the success of AMCON.

Kuru who was represented by Dr Uneze said, “We are just a government recovery agency saddled with the responsibility of purchasing non-performing loans from Banks and ensuring it is paid back using the instrumentality of the law. Unfortunately, it did not turn out to be that easy, through the instrumentality of the courts as we encountered a lot of challenges.

“The obligors get wiser by the day, deliberately causing orchestrated legal delays knowing that AMCON has a sunset date. The Act was amended in 2015 to address some of the encountered challenges, again obligors got wiser, hence necessitating another amendment in 2019 all with the single objective of recovering the loans bought from banks in order to settle our debt without recourse to taxpayers money, this outstanding exposure is not a small amount of money.

“…Due to the limited lifespan of AMCON, there is a need for a speedy and simplified litigation process. The reason is clear: AMCON is a special purpose vehicle for the recovery of ‘toxic’ debts.

The debts are so bad that the government had to purchase them to prevent a collapse of the economy. AMCON’s mandate is therefore to recover these debts for our common survival to be guaranteed. The rationale behind the AMCON regime is therefore to quickly recover the bad debts within a legal framework that ensures speed without compromising fair hearing.

“AMCON jurisprudence is primarily regulated by the AMCON Act 2010 (as amended in 2015 and 2019), Federal High Court Practice Directions of 2013 and The Federal High Court AMCON Rules 2018.

The Directions and the Rules have introduced a new culture of expediency in determining AMCON matters at the Federal High Court.

Therefore, it is imperative for you to understand the AMCON spirit, which means speed and efficiency.”

Insisting that AMCON needs all hands to be on deck, the CEO added, “The amended AMCON Act 2019 was a robust attempt to address the shortcomings in the erstwhile AMCON Instruments i.e., the 2010 Principal enactment and the 2015 amendment.

Recognizing the challenges inherent in these Instruments that undermine the realization of the AMCON mandate, the AMCON Act was further amended in 2019. The objective of this amendment is to enhance the Corporation’s capacity and improve the supporting mandate for enforcement.

“I must also reiterate that the amendment also became very necessary given our experience with recalcitrant debtors who constantly try to avoid, circumvent, and totally deny commitments and obligations.

These obligors rather than settle their indebtedness, prefer to rely on technicalities to frustrate the Corporation from acting against them.

“The amended Act has far-reaching implications to the mandates of the Corporation in resolving troubled assets especially as they relate to recalcitrant obligors. The amended Act reposed the Corporation with phenomenal powers that are disconnected from common sense and convention.

Accordingly, it is very essential that the Corporation embarks on extensive public awareness by engaging the Hon. Registrars and Legal Assistants to the Hon. Judges of the Federal High Court,” Kuru concluded.

The training, which was organised by the Dr. Fatihu Abba-led Legal Academy under the auspices of the office of the Chief Registrar of the Federal High Court was designed to enlighten Legal Assistants and Registrars of the Federal High Court on the AMCON mandate. It was themed, “The Role Of Registrars And Legal Assistants In The Effective And Efficient Realization Of AMCON Mandate.”