The Minister of Finance, Budget and National Planning, Zainab Ahmed, has said Nigerians will pay more taxes.

She said this has been captured in the medium term as proposed in the Finance Bill 2021.

The minister disclosed this Monday during a public hearing on the bill organised by the House of Representatives Committee on Finance.

She said: “While these issues may require modest increases in taxes and tariffs on certain businesses, sectors, industries and individuals over the medium term, this administration remains committed to continuous dialogue and engagement with all stakeholders and interest groups.”

Mrs Ahmed said Nigeria must diversify its revenues from oil to fund critical expenditures.

She said Nigeria also requires more fiscal reforms.

However, while some experts said it was wrong to increase taxes at this critical time, others said there was nothing wrong in collecting taxes from the right quarters.

They said the most important thing was for governments at all levels to account for what they collected in form of taxes and levies through providing critical infrastructure and services to the people.

FG’s incomes in outgoing year

The finance minister said as of September 2021, the federal government’s retained revenue was N4.56 trillion, achieving 75 per cent of the budget while its share of oil revenues was N845 billion, representing 56.3 per cent pro-rated performance.

According to her, the “Federal share of non-oil revenues was N1.31tr (117.3% above budget). Companies Income Tax (CIT) and Value Added Tax (VAT) collections were N616bn and N274.4bn representing 121% and 153%, respectively, of the pro-rata targets. Also, customs collections were N418.97bn.”

The minister said the current fiscal policy stance was to let tax incentives with sunset provisions to naturally expire and not to automatically renew them without a detailed tax expenditure cost and benefit evaluation of the relative success of the incentives before extending them further.

She said there will also be an acceleration of the projected increase in tariff and excise duties on tobacco, alcohol and carbonated drinks to fund vital expenditure on health, education, and security as well as wholesale reform of antiquated stamp duties and capital gains tax regime.

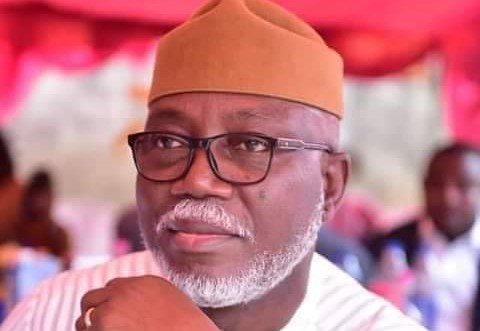

In his opening remark, the Speaker, Femi Gbajabiamila, who was represented by the Minority Leader, Ndudi Elumelu (PDP, Delta), said the 2021 Finance Bill seeks to introduce strategic and broadminded, positive reforms that would engender best practice, statutorily check borrowing by local, states and federal governments.

“It is instructive to state that the essence of the 2021 bill is to further reposition our finance system to plug wastes, close openings for corruption, create opportunities for employment as well as stimulate stability and growth in our productive sectors, within the wider context of our quest for economic recovery in our country,” he said. The chairman of the committee, James Abiodun Faleke (APC, Lagos), said the committee will analyse the submissions by the various stakeholders as regards the proposed amendments and submit its report.

A member of the committee, Mukhtar Ahmed (APC, Kaduna), called on the finance ministry and the Nigeria Customs Service (NCS) to speed up the excise duty on carbonated drinks which, he said, will reduce the increasing cases of diabetes.

‘Too early to name taxes to increase’

When one of our correspondents sought clarification from the finance minister to give specifics on the taxes and levies to be increased, Mrs Zainab said it was too early to give specifics.

“That will be too early as we are working to complete the current one,” she told our correspondent in a text message.

However, a source within the Ministry of Finance who craved anonymity, said whilst the Value Added Tax (VAT) would likely not be increased even after the litigations around it were completed, stamp duty might be increased.

“Even after the court cases, VAT might remain at 7.5 per cent but stamp duties might be raised. I can’t say to what percentage but it may likely be reviewed upward.”

He also said excise duties, especially for alcohol and other luxury items would be increased, adding that the conversation was already on.

He said capital gains tax, company income tax and others would be increased.

DailyTrust