Buhari’s aide, two ministers frustrating probe of suspicious N159 billion judgment debts

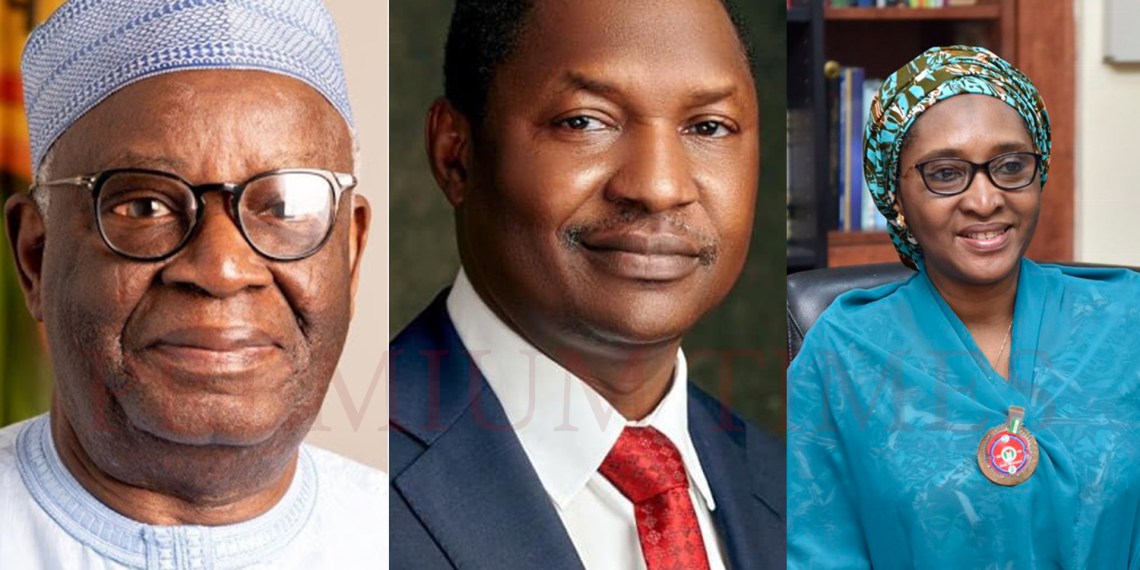

Thee is growing tension between Nigerian governors and a ring of powerful presidential aides over some $418 million (about N159 billion at the current official exchange rate of $1 to N380.5) said to be owed six individuals and entities who purportedly offered services to states and their local governments on the payment of Paris Club debts. While the top presidential aides led by the Chief of Staff to President Muhammadu Buhari, Ibrahim Gambari, are scrambling to start the disbursement as quickly as possible, the governors, under the aegis of the Nigeria Governors’ Forum (NGF), led by Governor Kayode Fayemi of Ekiti State, are making a last-ditch effort to stop it. PREMIUM TIMES is in possession of tens of sensitive correspondences exchanged by high-ranking players in the matter, highlighting desperate moves to begin the disbursements through the issuance of promissory notes that will be funded through deductions from states and local governments’ monthly allocations. From documents seen by this newspaper, the moves to begin the payments are against Mr Buhari’s directive issued in January this year, and in disregard for the red flag raised by the governors about the legitimacy of the indebtedness. The Fayemi-led NGF is demanding that the payment be suspended until a forensic audit of the indebtedness is carried out. But Mr Gambari, who is spearheading the moves for the prompt payment of the money, is backed by the Attorney-General of the Federation (AGF), Abubakar Malami, and the Minister of Finance, Zainab Ahmed, both of whom argue that the court judgments which awarded the sums to the creditors must be hurriedly obeyed. But among the three of them, Mr Malami is the only figure that has been in the picture since 2016 when the conversations among the top echelons of the Buhari administration about payment of government’s judgment debts started. Mr Gambari only became a party to the matter following his appointment in May 2020 after the death of his predecessor, Abba Kyari, who died from COVID-19 complications in April 2020. Mrs Ahmed also became involved following her appointment as finance minister after her predecessor, Kemi Adeosun, resigned in September 2018 in the wake of an NYSC certificate forgery scandal. The deals that piled up judgment debts against states, LGs Currently, the states and local governments are, by the calculations of both the Minister of Finance, Mrs Ahmed and Mr Malami, indebted to the tune of $418,953,670.59 (about N159 billion at the current official exchange rate of $1 to N380.5) to six individuals and entities. The breakdown of the debts is contained in a series of letters sent separately by Mrs Ahmed and Mr Malami to the President and the office of Mr Buhari’s Chief of Staff. PREMIUM TIMES exclusively obtained copies of these letters. The humongous debts arose from judgments passed in favour of the six claimants in four cases relating to the refund to the states and local governments, excess deductions made by the Federal Government between 1995 and 2002 to satisfy Paris and London clubs loans. According to the two ministers, the claimants or judgment creditors were engaged by the states and local governments as consultants or contractors “in the recovery” of the London/Paris clubs refunds, as well as in the “utilisation” of the recovered funds. They explained that the contracts and agreements were tied to the London/Paris clubs refunds, and the claimants had simply gone to court to claim their share of the money. PREMIUM TIMES has found out how the suits were designed to succeed with little or no chance of failure. Paris Club Refund Case: A Fait Accompli? As far back as 2013, long before the Federal Government started the disbursement of the excess deductions to the states and local governments in 2016, the Association of Local Governments of Nigeria (ALGON), in concert with some of the claimants, went to court to challenge what they described as the Federal Government’s unilateral deduction of the funds from the federation account to service the foreign debts without the consent of the third tier of governments in the country. The 776 local governments, which were the principal plaintiffs, cleverly instituted the suit along with the “consultants” and “contractors” which they claimed had provided legal and consultancy services to help them as members of ALGON to secure the refund of the deducted money. Some other parties were also joined as co-plaintiffs in the suit for executing projects such as “security and health care delivery” for all the local governments of the federation. With the monetary claims in the suit tied to the refund of the London/Paris Club refunds and the Federal Government agencies, which were sued as adverse parties, success was, no doubt certain. Between 2013 and 2018, a series of similar suits relating to the Paris and London clubs money were filed in court with ALGON and past leaderships of the NGF giving tacit support to the “contractors” and “consultants”. At the end of the day, some of the cases were feebly defended, while others were consented to by the defendants, including past NGF leaderships and ALGON. With little or no opposition, judgments later began to fly around with huge awards in millions of dollars issued by the courts in favour of the claimants. In his July 17, 2020 letter to the incumbent Chief of Staff, Mr Gambari, Mr Malami, who has been consistently making a case for the payment of the claimants since 2016, said the case ordinarily should not concern the Federal Government if not that the Central Bank of Nigeria (CBN) was the custodian of the funds. He stated, “The consultants/contractors obtained the judgments for the payment of their legal/consultancy fees which judgments were further backed up with garnishee order absolute against the Central Bank of Nigeria for the attachment of these sums.” Mr Malami explained that the Federal Government only got involved “in these claims” because “the attachment order made against the Central Bank of Nigeria and the Federal Government being the custodian and entity disbursing the funds or making