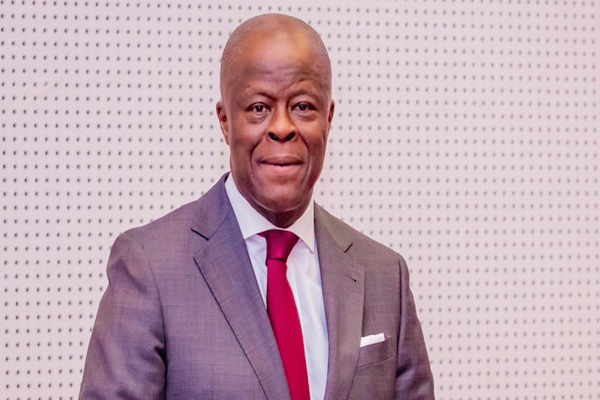

Wale Edun, minister of finance and coordinating minister of the economy, says there is liquidity in the Nigerian banking sector to reduce the foreign exchange (FX) backlog.

Edun spoke on Wednesday in an interview with Bloomberg.

The minister said the FX backlog is at about $5 billion and the Central Bank of Nigeria (CBN) is making efforts to cut it down.

He said there should be a way the banks can help with the backlog, either on a spot or a forward-rate basis, as the government believes it can pay down the backlog almost at once.

“There is actually liquidity within the banking system and there should be a way of getting the banks to actually help with that backlog, either on a spot or a forward-rate basis,” he said.

“We believe that if we coral the dollars that are available, we can pay down that backlog almost in one fell swoop.”

The minister said he is confident that it could be cleared easily if steps to lift oil revenue and mobilise dollars already in the economy succeed.

EDUN SAYS NIGERIA WOULD GET WORLD BANK LOAN

Speaking on the government’s plan to borrow $1.5 billion from the World Bank, Edun said the government is carrying out reforms that deserve financial support from the Bretton Woods institution.

“We’re hoping to get $1 billion or $1.5 billion from the World Bank,” Edun said.

“It is a matter of discussion at the moment, but we think we will get the support because we are continuing with our reforms.

“What we’ve done with fuel subsidies, what we have done in terms of the foreign-exchange market reform, deserve support.

“We’ve done enough and we deserve to be rewarded imminently.”

Edun also said the country is confident of having access to the Eurobond market, adding that plans are underway to tap it later this year if rates move sufficiently lower.

“The major issuers and the book runners have told us that there should be a window for Nigeria in the Eurobond market,” he added.

EDUN: WE WILL GET IN MORE LIQUIDITY TO STABILISE NAIRA

On stabilising the naira, the finance minister said the government plans to utilise all available liquid.

“The priority is to stabilise the naira, that means getting in the additional liquidity – number one from oil revenue,” Edun said.

“We’re also looking to make sure we tap Nigerian savings, in particular domestic dollar savings both inside and outside the formal market. There’s a lot of cash in the Nigerian economy.”

Since the unification of the exchange rate windows, the Nigerian currency, naira, and the forex market have been volatile.

Due to the lack of dollars in the forex market, the naira has struggled to meet the demands of importers and exporters during transactions, thereby affecting businesses.

The apex bank as well as the federal government has made efforts to rejuvenate the economy by introducing strategic reforms.

As one of the solutions to economic stability, the federal government has ensured that oil production increases and also revamped the Port Harcourt refinery and supported the operations of the Dangote refinery.

This, the federal government believes, would support forex inflow.

In October 2023, the federal executive council (FEC) approved a $1.58 billion loan request.

The minister of finance had said the loan request is split into two; $1.5 billion from the World Bank and $80 million from the African Development Bank (AfDB).